A Comprehensive Guide on How to Transfer Loan to Another Person: Step-by-Step Instructions and Important Considerations

#### How to Transfer Loan to Another PersonTransferring a loan to another person can be a complex process that involves various steps and considerations. Wh……

#### How to Transfer Loan to Another Person

Transferring a loan to another person can be a complex process that involves various steps and considerations. Whether you're looking to help a friend or family member, or you're in a situation where you need to pass on your financial obligations, understanding how to transfer a loan to another person is essential. This guide will explore the steps involved, the implications of transferring a loan, and the factors you need to consider before making this decision.

#### Understanding Loan Transfer

Before diving into the process, it's crucial to understand what loan transfer means. Transferring a loan typically involves changing the borrower on the loan agreement, allowing someone else to take over the payments and the responsibility of the debt. This can apply to various types of loans, including personal loans, car loans, and mortgages.

#### Steps to Transfer a Loan

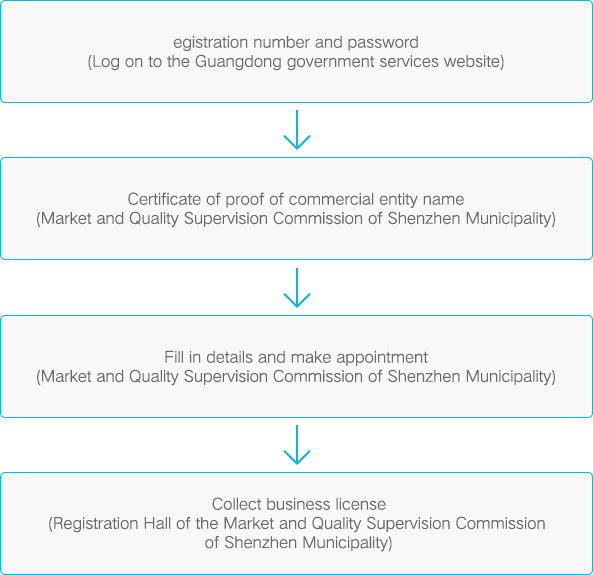

1. **Check Loan Agreement**: The first step in how to transfer a loan to another person is to review your loan agreement. Some agreements may have specific clauses regarding the transfer of the loan. Look for terms like "loan assumption" or "transfer of obligation" to understand your options.

2. **Contact Your Lender**: Once you’ve reviewed your agreement, the next step is to contact your lender. Inform them of your intention to transfer the loan and ask about their policies. Some lenders may allow loan transfers, while others may not.

3. **Qualify the New Borrower**: If the lender permits the transfer, the next step is to ensure that the new borrower qualifies for the loan. This typically involves a credit check and income verification to ensure they can manage the loan payments.

4. **Complete Required Paperwork**: If the new borrower qualifies, you will need to complete the necessary paperwork to officially transfer the loan. This may include a loan assumption agreement and other legal documents.

5. **Finalize the Transfer**: After submitting the required documents, the lender will review them and finalize the transfer. Once approved, the new borrower will take over the loan, and you will be released from any further obligations.

#### Important Considerations

- **Credit Impact**: One of the most significant factors to consider when transferring a loan is the impact on your credit score. If the loan is transferred successfully, your credit report should reflect that you are no longer responsible for the debt. However, if the new borrower defaults, it could still affect your credit if the lender does not officially release you from the obligation.

- **Fees and Costs**: Some lenders may charge fees for processing a loan transfer. Be sure to ask about any potential costs involved in the process.

- **Legal Implications**: Depending on the type of loan, there may be legal implications to consider. It’s advisable to consult with a legal professional to understand your rights and responsibilities during the transfer process.

- **Alternative Options**: If the lender does not allow for a loan transfer, consider alternative options such as refinancing the loan in the new borrower's name or selling the asset associated with the loan.

#### Conclusion

Transferring a loan to another person can be a practical solution in various situations, but it requires careful consideration and understanding of the process. By following the steps outlined in this guide and being aware of the implications, you can navigate the loan transfer process more effectively. Always communicate openly with your lender and the new borrower to ensure a smooth transition.