"Understanding Oregon Payday Loans: Your Comprehensive Guide to Quick Financial Solutions"

#### Oregon Payday LoansIn today's fast-paced world, many individuals find themselves in need of quick financial assistance. For residents of Oregon, one of……

#### Oregon Payday Loans

In today's fast-paced world, many individuals find themselves in need of quick financial assistance. For residents of Oregon, one of the most accessible options is the Oregon Payday Loans. These short-term loans are designed to help borrowers cover unexpected expenses or bridge the gap between paychecks. However, before diving into the world of payday loans, it is essential to understand what they are, how they work, and the potential risks involved.

#### What Are Oregon Payday Loans?

Oregon payday loans are small, short-term loans that are typically due on your next payday. They are often used for urgent financial needs, such as medical bills, car repairs, or other unexpected expenses. Borrowers can apply for these loans online or in person, and the application process is usually quick and straightforward. Most lenders require minimal documentation, making it easy for individuals to access funds quickly.

#### How Do Oregon Payday Loans Work?

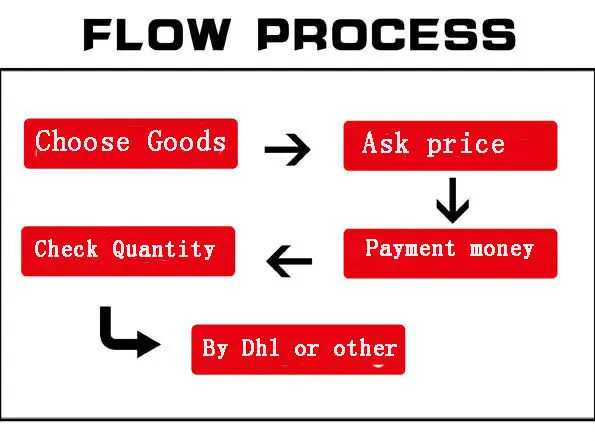

The process for obtaining an Oregon Payday Loan generally involves the following steps:

1. **Application**: You can apply for a payday loan online or at a physical location. The application typically requires personal information, proof of income, and a valid ID.

2. **Approval**: Once your application is submitted, the lender will review your information. If approved, you will receive a loan offer detailing the amount, fees, and repayment terms.

3. **Funding**: If you accept the loan offer, the funds are usually deposited into your bank account within one business day.

4. **Repayment**: The loan is typically due on your next payday. Some lenders may offer the option to extend the repayment period, but this often comes with additional fees.

#### Benefits of Oregon Payday Loans

One of the primary advantages of Oregon Payday Loans is their accessibility. They provide a quick solution for individuals facing financial emergencies. Additionally, the application process is often less stringent than traditional loans, making it easier for those with poor credit histories to obtain funding. Furthermore, payday loans can help borrowers avoid late fees on bills or bounced checks, which can lead to even more financial strain.

#### Risks and Considerations

While Oregon Payday Loans can offer immediate financial relief, they also come with significant risks. The most notable concern is the high-interest rates associated with these loans. Borrowers may find themselves trapped in a cycle of debt if they cannot repay the loan on time, leading to the need for additional loans to cover the original debt.

It's crucial for potential borrowers to carefully assess their financial situation before taking out a payday loan. Consider alternative options, such as personal loans from banks or credit unions, which may offer lower interest rates and more favorable repayment terms.

#### Conclusion

In summary, Oregon Payday Loans can be a valuable resource for individuals in need of quick financial assistance. However, it is essential to approach these loans with caution. Understanding the terms, fees, and potential risks can help borrowers make informed decisions. Always consider your ability to repay the loan on time and explore other financing options that may be available to you. By doing so, you can navigate the world of payday loans more effectively and avoid falling into a cycle of debt.