Comprehensive Insights: First Convenience Bank Auto Loan Reviews for Smart Borrowers

Guide or Summary:Understanding the Loan OptionsCompetitive Interest RatesCustomer Service ExperienceOnline Tools and ResourcesPotential DrawbacksConclusion……

Guide or Summary:

- Understanding the Loan Options

- Competitive Interest Rates

- Customer Service Experience

- Online Tools and Resources

- Potential Drawbacks

- Conclusion: Is First Convenience Bank Right for You?

When it comes to securing an auto loan, making an informed decision is crucial. That's why we've compiled extensive First Convenience Bank Auto Loan Reviews to guide you through the process. Whether you're a first-time buyer or looking to refinance, understanding the ins and outs of the offerings from First Convenience Bank can significantly impact your financial future.

First Convenience Bank is known for its customer-centric approach, offering a range of auto loan options to suit various needs. Their auto loans typically feature competitive interest rates, flexible repayment terms, and the possibility of pre-approval, making them an attractive choice for many borrowers. In this article, we delve into the key aspects of their auto loan services, drawing from numerous First Convenience Bank Auto Loan Reviews to provide a balanced perspective.

Understanding the Loan Options

One of the standout features highlighted in First Convenience Bank Auto Loan Reviews is the variety of loan options available. Borrowers can choose between new and used car loans, as well as refinancing options for those looking to lower their current payments. The bank's flexibility in terms of loan amounts and repayment periods allows customers to tailor their loans to fit their budgets and financial goals.

Competitive Interest Rates

Interest rates are a critical factor when it comes to auto loans, and many reviewers note that First Convenience Bank offers competitive rates compared to other lenders. The bank's commitment to transparency means that potential borrowers can easily access information about current rates and terms, making it easier to compare options. As highlighted in several First Convenience Bank Auto Loan Reviews, this transparency builds trust and helps customers feel more confident in their borrowing decisions.

Customer Service Experience

Another aspect frequently mentioned in First Convenience Bank Auto Loan Reviews is the quality of customer service. Many customers appreciate the bank's knowledgeable staff who are willing to assist with any questions throughout the loan process. From initial inquiries to closing the loan, the support provided by First Convenience Bank can make a significant difference in the overall experience. Positive interactions with customer service representatives often lead to higher satisfaction rates among borrowers.

Online Tools and Resources

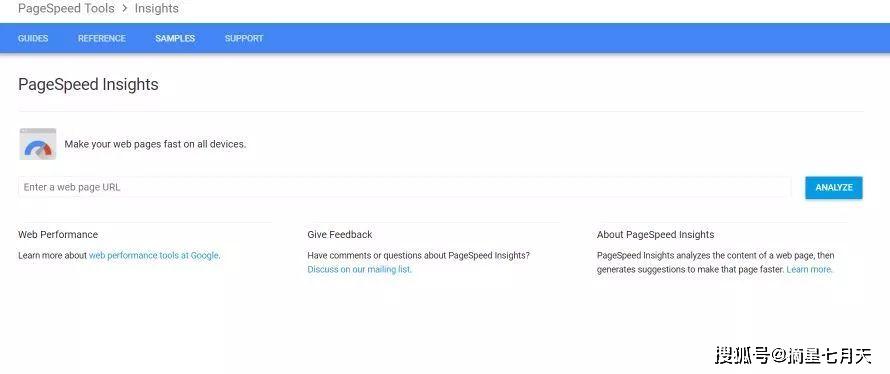

In today’s digital age, having access to online tools is essential for a smooth loan application process. First Convenience Bank offers a user-friendly online platform that allows borrowers to apply for loans, check rates, and manage their accounts conveniently. As noted in various First Convenience Bank Auto Loan Reviews, the ease of use and accessibility of these online resources enhance the overall customer experience, making it easier for borrowers to stay informed and in control.

Potential Drawbacks

While many First Convenience Bank Auto Loan Reviews are overwhelmingly positive, it's essential to consider potential drawbacks. Some customers have reported that the application process can be lengthy, particularly if additional documentation is required. Additionally, certain borrowers may find that the loan terms are not as flexible as those offered by some competitors. It's crucial to weigh these factors against the benefits when deciding whether to pursue a loan with First Convenience Bank.

Conclusion: Is First Convenience Bank Right for You?

In summary, First Convenience Bank Auto Loan Reviews present a mixed yet largely favorable picture of the bank's auto loan offerings. With competitive rates, a variety of loan options, and a focus on customer service, First Convenience Bank stands out as a viable choice for many borrowers. However, as with any financial decision, it's essential to conduct thorough research and consider your unique circumstances before committing to a loan. By utilizing the insights from these reviews, you can make a more informed choice that aligns with your financial goals.