Unlock Your Dream Home: The Ideal Credit Score for Mortgage Loan Approval

When it comes to securing a mortgage loan, one of the most critical factors lenders consider is your credit score. Understanding the **ideal credit score fo……

When it comes to securing a mortgage loan, one of the most critical factors lenders consider is your credit score. Understanding the **ideal credit score for mortgage loan** approval can significantly impact your home-buying journey. A strong credit score not only increases your chances of loan approval but can also lead to better interest rates, saving you thousands over the life of your loan.

### What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It is calculated based on your credit history, including your payment history, amounts owed, length of credit history, new credit, and types of credit used. The higher your score, the more favorable lenders view you as a borrower.

### The Ideal Credit Score for Mortgage Loan

So, what exactly is the **ideal credit score for mortgage loan** approval? Generally, a score of 740 or above is considered excellent and will give you access to the best mortgage rates. However, it’s essential to note that different lenders may have varying criteria. Here’s a breakdown of credit score ranges and their implications for mortgage loans:

- **300-579**: Poor credit. Homebuyers in this range may struggle to secure a mortgage and will likely face high-interest rates if approved.

- **580-669**: Fair credit. You may qualify for an FHA loan, but expect higher rates and less favorable terms.

- **670-739**: Good credit. This range is where many lenders start to offer competitive rates and terms.

- **740-799**: Very good credit. Homebuyers in this range typically enjoy excellent interest rates and loan terms.

- **800-850**: Exceptional credit. Borrowers with scores in this range are seen as low-risk and can negotiate the best rates available.

### Why is the Ideal Credit Score Important?

Achieving the **ideal credit score for mortgage loan** approval is essential for several reasons:

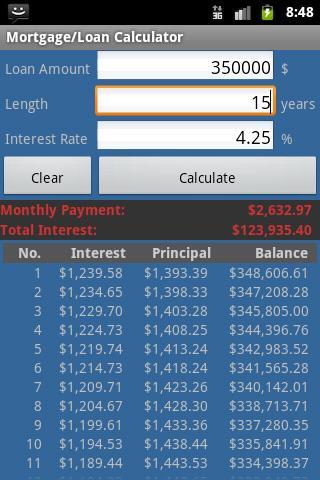

1. **Lower Interest Rates**: A higher credit score often translates to lower interest rates, which can save you a significant amount of money over the life of your loan. Even a small difference in interest rates can lead to thousands of dollars in savings.

2. **Better Loan Terms**: Lenders are more likely to offer favorable terms, such as lower down payments, for borrowers with higher credit scores. This can make homeownership more accessible and affordable.

3. **Increased Approval Chances**: A strong credit score enhances your likelihood of being approved for a mortgage loan, especially in competitive housing markets.

### How to Improve Your Credit Score

If your credit score is below the ideal range, don’t worry! There are steps you can take to improve it:

- **Pay Your Bills on Time**: Consistent, on-time payments are crucial for maintaining a good credit score.

- **Reduce Debt**: Aim to lower your credit utilization ratio by paying down existing debt.

- **Avoid New Credit Applications**: Each new credit inquiry can temporarily lower your score, so avoid applying for new credit before seeking a mortgage.

- **Check Your Credit Report**: Regularly review your credit report for errors and dispute any inaccuracies.

### Conclusion

Understanding the **ideal credit score for mortgage loan** approval is the first step toward achieving your dream of homeownership. By working to improve your credit score, you can unlock better mortgage options and make your home-buying experience more enjoyable and financially sound. Whether you're a first-time homebuyer or looking to refinance, knowing your credit score and taking proactive steps can lead you to the keys of your new home. Start today, and pave the way for a brighter financial future!