Unlocking Savings: Understanding the Average Cost to Refinance Home Loan for Maximum Benefits

#### Description:Refinancing your home loan can be a strategic financial move, allowing homeowners to reduce their monthly payments, secure a lower interest……

#### Description:

Refinancing your home loan can be a strategic financial move, allowing homeowners to reduce their monthly payments, secure a lower interest rate, or even tap into their home equity. However, before diving into the refinancing process, it’s crucial to understand the **average cost to refinance home loan** and how it can impact your overall savings.

When considering refinancing, many homeowners often overlook the costs associated with the process. The **average cost to refinance home loan** typically ranges from 2% to 5% of the loan amount. This includes various fees such as application fees, appraisal fees, title insurance, and closing costs. For example, if you are refinancing a $300,000 mortgage, you might expect to pay between $6,000 and $15,000 in refinancing costs.

Understanding these costs is essential in determining whether refinancing is the right choice for you. To make an informed decision, consider the following factors:

1. **Interest Rate Reduction**: One of the primary reasons homeowners refinance is to secure a lower interest rate. Even a small reduction can lead to significant savings over the life of the loan. For instance, if you refinance from a 4.5% interest rate to a 3.5% rate, you could save thousands of dollars in interest payments.

2. **Break-Even Point**: It’s essential to calculate your break-even point when refinancing. This is the time it will take for your savings from the lower monthly payments to exceed the costs of refinancing. If your **average cost to refinance home loan** is $10,000 and you save $200 per month, your break-even point would be 50 months, or just over four years. If you plan to stay in your home longer than that, refinancing could be a wise financial decision.

3. **Loan Term Considerations**: Refinancing can also change the term of your loan. While many homeowners opt for a 30-year mortgage, switching to a 15-year mortgage can save you a significant amount in interest, even if your monthly payments are higher. Understanding how the **average cost to refinance home loan** impacts your loan term is crucial for making the best choice.

4. **Equity and Cash-Out Refinancing**: If your home has appreciated in value, you may have built up equity that you can tap into through cash-out refinancing. This allows you to take out a new loan for more than what you owe and receive the difference in cash. However, it’s important to factor in the **average cost to refinance home loan** to ensure that this option aligns with your financial goals.

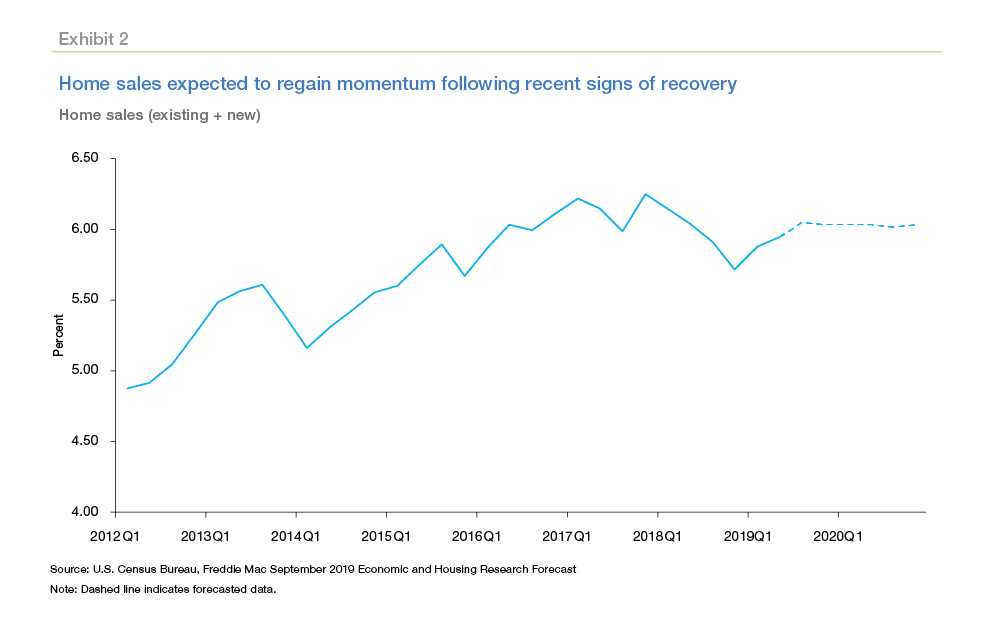

5. **Market Conditions**: Lastly, keep an eye on market conditions. Interest rates fluctuate based on economic factors, and timing your refinance can significantly affect your costs. Staying informed about the current rates and understanding the **average cost to refinance home loan** can help you make a timely decision.

In conclusion, while the **average cost to refinance home loan** may seem daunting, the potential savings and benefits can outweigh the initial expenses. By evaluating your financial situation, understanding the costs involved, and considering your long-term goals, you can determine if refinancing is the right path for you. Always consult with a financial advisor or mortgage professional to ensure you’re making the best decision tailored to your unique circumstances. Refinancing could be the key to unlocking substantial savings and improving your financial future!