Unlock Your Financial Future: Discover the Best 550 Credit Score Loan Options Available Today

Guide or Summary:Understanding 550 Credit Score LoansTypes of Loans Available for a 550 Credit ScoreImproving Your Chances of ApprovalThe Importance of Resp……

Guide or Summary:

- Understanding 550 Credit Score Loans

- Types of Loans Available for a 550 Credit Score

- Improving Your Chances of Approval

- The Importance of Responsible Borrowing

Understanding 550 Credit Score Loans

If you find yourself in the challenging position of having a 550 credit score, you may feel disheartened when it comes to securing a loan. However, it’s important to know that there are options available specifically tailored for individuals in your situation. A 550 credit score is considered poor by most lending standards, which can limit your borrowing options. Nevertheless, understanding how to navigate the lending landscape can help you access the funds you need.

Types of Loans Available for a 550 Credit Score

When searching for a loan with a 550 credit score, there are several types of loans to consider. Each comes with its own terms, interest rates, and eligibility criteria. Here are some common options:

1. **Personal Loans**: Many lenders offer personal loans to individuals with low credit scores. These loans can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. However, be prepared for higher interest rates due to the increased risk for lenders.

2. **Secured Loans**: If you have collateral, such as a vehicle or savings account, you might qualify for a secured loan. This type of loan typically offers lower interest rates since the lender has an asset to claim if you default.

3. **Payday Loans**: While not recommended due to their exorbitant interest rates and short repayment periods, payday loans are an option for immediate cash needs. It's crucial to understand the risks and potential for a debt cycle before considering this route.

4. **Credit Union Loans**: Credit unions often have more flexible lending criteria compared to traditional banks. If you are a member of a credit union, inquire about their loan options for individuals with lower credit scores.

5. **Peer-to-Peer Lending**: Platforms that facilitate peer-to-peer lending connect borrowers with individual investors. This can be a viable option for those with a 550 credit score, as some investors may be willing to take on the risk for a higher return.

Improving Your Chances of Approval

While obtaining a loan with a 550 credit score may seem daunting, there are steps you can take to improve your chances of approval:

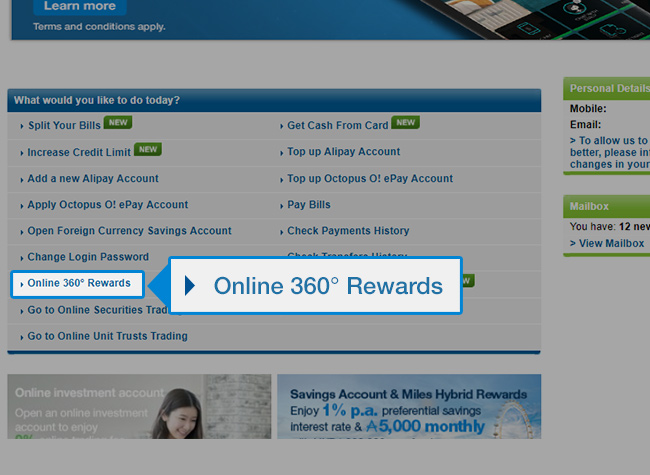

- **Check Your Credit Report**: Before applying for a loan, review your credit report for any inaccuracies or errors. Disputing these can help improve your credit score.

- **Provide Documentation**: Lenders often want to see proof of income, employment, and other financial documents. Having these ready can streamline your application process.

- **Consider a Co-Signer**: If possible, find someone with a stronger credit score to co-sign your loan. This can significantly increase your chances of approval and may result in better loan terms.

- **Shop Around**: Don’t settle for the first loan offer you receive. Different lenders have varying criteria, so it's beneficial to compare options to find the best terms available for your situation.

The Importance of Responsible Borrowing

While securing a loan with a 550 credit score can provide immediate financial relief, it’s essential to approach borrowing responsibly. High-interest rates can lead to a cycle of debt if payments are not managed properly. Always assess your ability to repay the loan before committing. Consider creating a budget to ensure that you can meet your payment obligations without straining your finances.

Additionally, using the loan to improve your financial situation—such as consolidating high-interest debt or funding a necessary expense—can be a strategic move. With responsible borrowing and timely payments, you can begin to rebuild your credit score, opening up more favorable loan options in the future.

In conclusion, while a 550 credit score presents challenges in securing a loan, it is not an insurmountable barrier. By understanding your options, improving your chances of approval, and borrowing responsibly, you can find a loan that meets your needs. Take the first step towards financial empowerment by exploring the various 550 credit score loan options available to you today.