"Unlock Your Dream Home: How to Use a Home Loan Calculator Approval for the Best Mortgage Rates"

#### Home Loan Calculator ApprovalWhen it comes to purchasing a home, understanding your financing options is crucial. One of the most effective tools at yo……

#### Home Loan Calculator Approval

When it comes to purchasing a home, understanding your financing options is crucial. One of the most effective tools at your disposal is the **home loan calculator approval**. This tool not only helps you determine how much you can borrow but also gives you insights into your monthly payments, interest rates, and overall affordability.

#### What is a Home Loan Calculator Approval?

A **home loan calculator approval** is an online tool that allows potential homebuyers to input their financial information and receive an estimate of their mortgage eligibility. By entering details such as income, existing debts, credit score, and down payment amount, users can gain a clearer picture of what they can afford. This calculator is particularly useful for first-time homebuyers who may be unfamiliar with the mortgage process.

#### Why Use a Home Loan Calculator Approval?

Using a **home loan calculator approval** offers several advantages:

1. **Budgeting**: It helps you establish a realistic budget for your home purchase. Knowing your maximum loan amount can guide your search and prevent you from falling in love with properties that are out of reach.

2. **Interest Rates**: The calculator can provide estimates based on current interest rates, allowing you to see how different rates impact your monthly payments. This information is vital for making informed decisions.

3. **Down Payment Insights**: It can show how varying down payment amounts affect your loan approval and monthly payments, helping you strategize your savings.

4. **Debt-to-Income Ratio**: The calculator can help you understand your debt-to-income ratio, a critical factor lenders consider when approving loans.

5. **Pre-Approval Preparation**: By using a calculator, you can prepare better for the pre-approval process, making it easier to gather the necessary documentation and present a compelling case to lenders.

#### How to Use a Home Loan Calculator Approval

Using a **home loan calculator approval** is straightforward. Here are the steps to follow:

1. **Gather Financial Information**: Collect your income details, monthly debt payments, credit score, and the amount you can afford for a down payment.

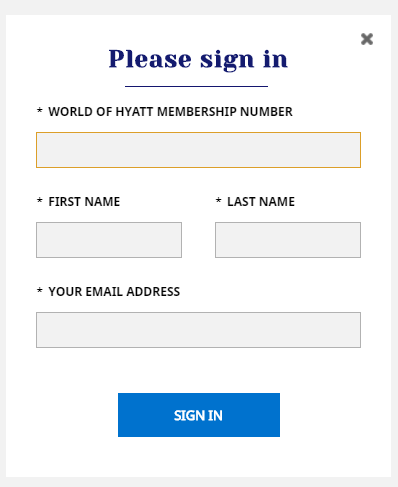

2. **Access the Calculator**: Many financial websites and banks offer free home loan calculators. Find a reputable one that includes approval estimates.

3. **Input Your Data**: Enter your financial information into the calculator. Be as accurate as possible to get the best estimates.

4. **Analyze the Results**: Review the estimated loan amount, monthly payments, and total interest paid over the life of the loan. This information will help you make informed decisions.

5. **Adjust Variables**: Experiment with different down payment amounts and interest rates to see how they affect your results. This can help you strategize your finances better.

#### Conclusion

A **home loan calculator approval** is an invaluable resource for anyone looking to buy a home. By providing insights into your borrowing capacity and potential monthly payments, it empowers you to make informed decisions throughout the home-buying process. Whether you are a first-time buyer or looking to refinance, utilizing this tool can save you time, money, and stress. Start using a home loan calculator today to unlock the door to your dream home!